It has been, in the terms of just one unhappy Mississippi contact centre employee, “a really hard pill to swallow.”

Every day Lanycha Corridor, who performs for the federal contractor Maximus at its facility in Hattiesburg, can help folks enroll in Affordable Care Act well being insurance policy designs.

But Corridor mentioned she just can’t find the money for her very own corporation-sponsored wellness insurance coverage.

“When I understood I could not manage that for the reason that my deductible was so superior, I just had to choose a working day off because I just couldn’t aim on serving to anyone when I could not manage my individual medication,” she reported.

Hall’s co-employee Sherry Collier stated they “work for a seller who is offering assist to the common general public, but we, as staff, simply cannot get the economical coverage we need to have.”

“I’m serving to persons producing under $25,000, and I’m making beneath $25,000,” Collier said. “Their co-payments are like $25, and their premiums per month may well be zero pounds, and I’m shelling out $4,500 for a top quality for each yr. How can that be? Which is just thoroughly ridiculous.”

Maximus connect with middle worker Trinity Davis reported she loves aiding people enroll in Obamacare, but her times at the corporation might be numbered if the wellness treatment charges never go down. She said she by now moonlights as a food items supply driver to continue to keep herself afloat. She claimed she is seriously considering going back again to her terrible outdated task because the added benefits ended up better.

“I slung chicken for about four many years,” Davis explained, utilizing slang to describe doing work in a hen processing plant. “And I really do not know if any of you fellas have finished that kind of operate, that is a depressing job. It is a hostile perform natural environment.”

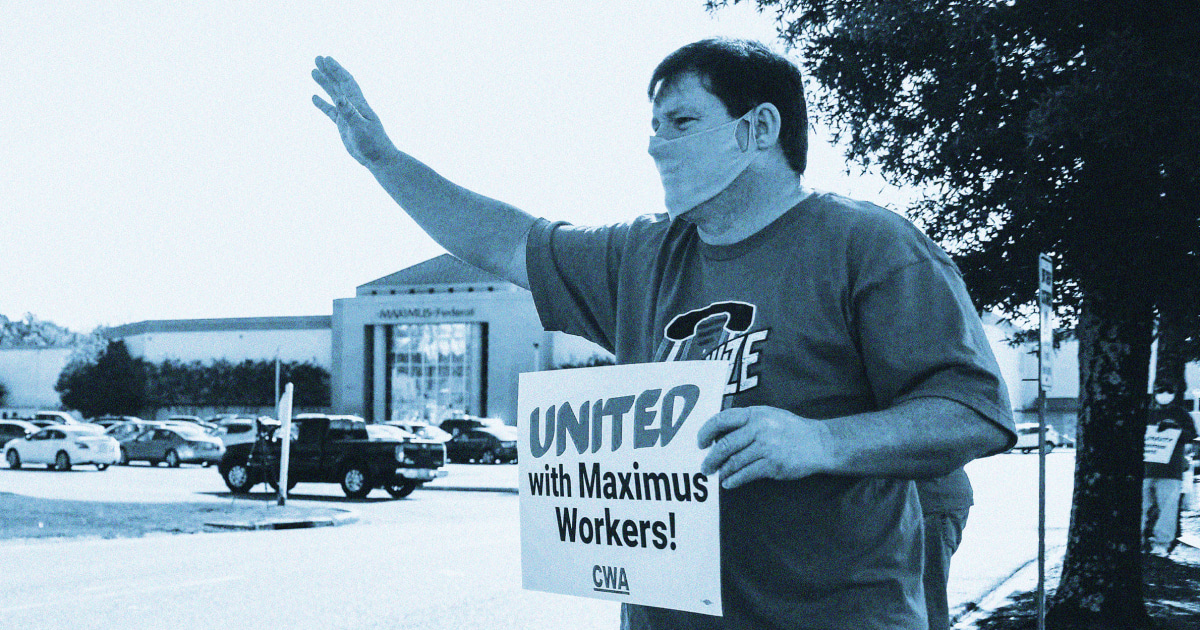

Anger about significant-cost wellness coverage, coupled with other prolonged-standing place of work issues, has served gasoline the ongoing generate by the Interaction Staff of The us to unionize call center workers like individuals used at the Maximus facility in Hattiesburg.

A few-quarters of these staff are women of all ages and concerning 45 and 55 p.c of the overall workforce are parents, the CWA says.

Very last yr, Maximus was accused by a whistleblower of endangering get in touch with middle workers in Hattiesburg by failing to abide by federal Facilities for Condition Management and Prevention guidelines by earning them work in crowded disorders.

Aspect of the career is to give callers with CDC direction info on how to keep risk-free all through a pandemic by carrying masks and social distancing.

In the conclusion, Maximus workforce who had been anxious about working in crowded conditions were being permitted to operate from residence and had been delivered with the machines to do so.

Maximus get in touch with centre personnel “have helped hundreds of thousands of Individuals accessibility reasonably priced wellness care,” Sanchioni Butler of the Mississippi AFL-CIO explained in a movie ready by the CWA. “They are battling to afford to pay for their individual. Permit that sink in for a moment.”

In response, a Maximus spokeswoman said that when the organization took more than the phone centre in 2018, it inherited an costly well being coverage agreement that expired in December and has been changed by a substantially more affordable plan.

“Workers can pick amongst a approach that has a $1,500 yearly deductible with an personnel contribution of $75 for every paycheck,” Eileen Rivera mentioned in an email. “We also supply yet another system that has no month to month high quality and has a $4,500 deductible.”

Rivera also denied that Maximus doubled the deductible though in the midst of the pandemic.

“The fact is, and contrary to these assertions, Maximus essentially lowered the once-a-year deductible from $2,500 under the past inherited prepare to $1,500,” Rivera reported.

The amounts cited by Rivera are for individuals, not for people, according the Maximus added benefits guide for 2022 seen by NBC News.

There are two program solutions: the main approach and the buy-up approach. Just one has a decrease deductible but bigger staff contributions. The main program has a $4,500 deductible for men and women, but that volume doubles to $9,000 for families. As soon as that’s met, staff members are on the hook for 30 per cent of further costs until finally they meet up with the “annual out-of-pocket maximum” of $12,000. Underneath the other program, the personal deductible is $1,500 and $3,000 for households.

“Once you access the out-of-pocket optimum, the strategy will pay for 100{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} of your well being treatment solutions for the relaxation of the year,” the program stated.

Biweekly payroll deductions for families beneath the core strategy are $574.77, and they are $791.13 for the purchase-up plan.

Just one of the Maximus simply call center employees interviewed by NBC News is enrolled in an person strategy, and all a few have persistent wellbeing concerns that make getting economical insurance policies a will have to.

Collier, who is a married 58-12 months-outdated mother of two grown small children, has diabetic issues. Corridor is 48, married with three kids and legally blind.

Davis, 43, is not married and has no kids. But she is diabetic and stated the expense of her prescriptions, less than the Maximus program, skyrocketed in the latest several years from $30 to $400 a month, and she makes just $11 an hour.

Maximus, in a directive to workers in the system overview, also produced apparent that staff have primarily no selection but to indication up for its health and fitness insurance policy.

“You will only be equipped to decide out of healthcare protection if you have satisfactory healthcare coverage from an additional supply or particular person, this sort of as your husband or wife,” it explained.

Collier claimed a single of the side outcomes of her diabetic issues is leg discomfort, for which her health care provider despatched her to a professional. That co-pay was $125, she reported.

“I got sent for an X-ray, and that was an added $325,” she explained. “I just bought two payments. I just cannot manage to pay out them, but I just can’t afford to not go to the medical professional.”

Being on Maximus’ insurance policy has forced Collier to contemplate other, unproven options to lower her blood sugar stage, she mentioned.

“I’m looking into it’s possible self-medicating with apple cider vinegar,” Collier said.

The jury is nonetheless out on regardless of whether apple cider vinegar basically allows people with diabetes.

Hall, who has been doing the job for the corporation considering that 2018, became eligible for Medicare in 2020. She stated she gets an injection in her appropriate eye every 30 days that expenses $1,500.

Underneath Medicare, Hall stated she’d be equipped to afford to pay for it. But less than the Maximus strategy, any worker who is on Medicare or Medicaid has to give it up and enroll in the company strategy.

Hall stated she was warned that she would be “double-dipping” if she went with Medicare or attempted to enroll her individual spouse and children in a system by means of the Cost-effective Treatment Act market.

“That is preposterous,” Corridor mentioned. “With my revenue, I would have to pay out tiny to no high quality or get on Medicaid simply because my wages are regarded beneath poverty degree. I absolutely can’t afford loved ones coverage by way of Maximus.”

Hall reported she spoke to her supervisors and the company’s human resources consultant about her predicament final 12 months.

“With no assistance. I emailed Bruce Caswell inquiring for aid,” she reported.

Caswell is the business president.

“Mr. Caswell responded by apologizing and connecting me with the man or woman who does the negotiations for Maximus coverage,” Corridor said. “She told me there was nothing at all she could do to assistance me at the present time but that she would be aware of my considerations for the future 2021 yr.”

Caswell could not be reached for remark, but Rivera confirmed that Hall emailed him and that a member of the company’s human methods group known as Hall on July 13, 2020 and “spent some time strolling her by the benefits.”

Karen Pollitz, a senior fellow at the Kaiser Relatives Basis and an skilled on overall health reform and non-public insurance policies, declined to remark specifically about the insurance policies that Maximus features its workers.

But in an e mail, Pollitz explained underneath the present-day procedures, persons who are presented a business program are not qualified for ACA subsidies until their coverage is unaffordable or insufficient.

“A $4,000 deductible does not render a policy inadequate less than the ACA regulations,” Pollitz wrote. “If the plan’s out-of-pocket optimum is $8,700-a-calendar year or much less (two times that for a household coverage), and if the coverage handles hospitalization and healthcare visits, then it passes the bare minimum price take a look at.”

That claimed, “under these thresholds, it is undoubtedly probable that personnel at Maximus or other companies could, by the figures, get a much better deal via a subsidized ACA market strategy,” Pollitz wrote. “But for now, that ‘firewall’ blocks their eligibility for ACA marketplace subsidies.”

Beneath President Joe Biden’s proposed Establish Again Far better approach, there is a provision that would slightly cut down the price for staff enrolled in business-sponsored ideas, but it would not get rid of the firewall, Pollitz said.

“I really like my position. I adore executing what I do. I appreciate getting in a position to aid the beneficiaries,” Davis claimed. But she claimed the insurance policies Maximus delivers the workers who support individuals enroll in ACA plans is “a slap in the deal with.”

More Stories

The Layers of CMMC Compliance with a CMMC Consultant’s Aid

Fairy House: A Journey into the Magical World of Miniature Dwellings

How to promote your trips to Baku on social media