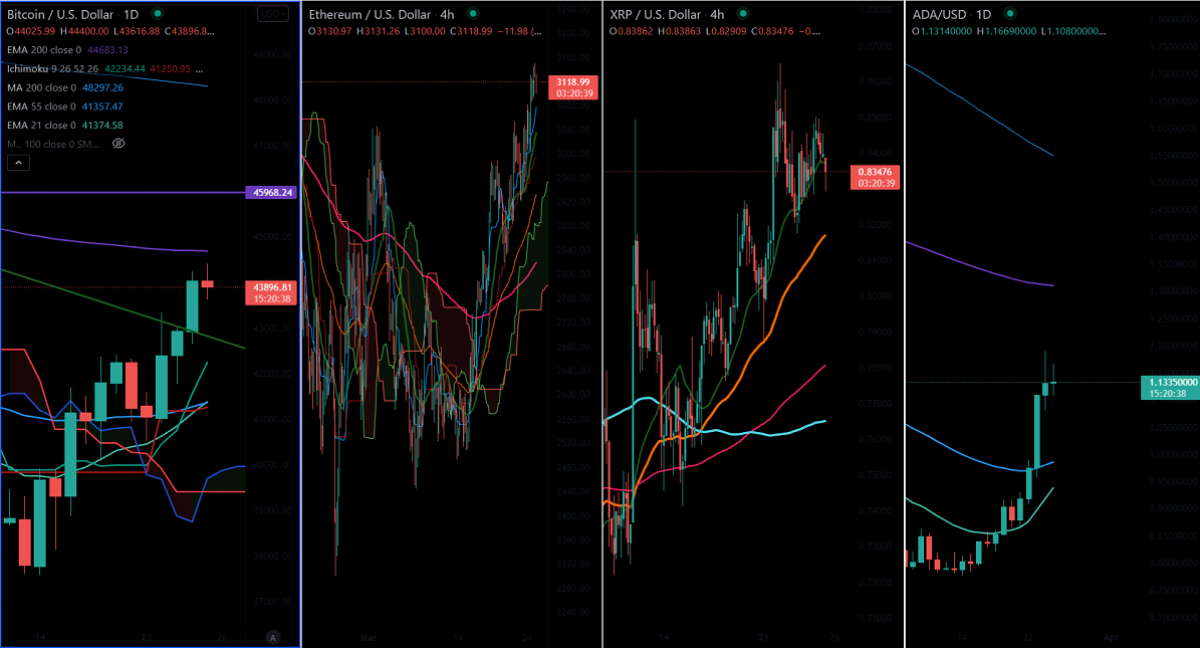

Bitcoin (BTC/USD) Analysis

Key Highlights

BTC trades higher for the third consecutive day and hits the highest level since Mar 3rd. The pair gained sharply after news that Russia could accept Bitcoin for oil and gas payments. It is holding above the symmetric triangle which shows that BTC is expected to touch $45,850 (Feb 10th high).

Technical Analysis

Intraday trend – Bullish

On the daily chart, the pair is trading above Tenken-sen ($41,552), Kijun-sen ($41,174), and Ichimoku Kumo cloud ($39,400). It hit an intraday high of $44,400 and is currently trading around $44,062.

Major support is seen at $43,500, any violation below this level confirms intraday bearishness. A dip till $42,500/$41,700/$41,000/$40,450/$39,000/$37,000 (Mar 7th low) is possible.

The immediate resistance is seen around $45,000 – any surge past targets $46,000. Major bullishness can happen only if it breaks $46,000; at that point a rise to $50,000/$52,000 is likely.

RSI – Bullish

A possible strategy could be long on dips $43,500 with SL around $42,500 for TP of $50,000.

ETH/USD Daily Outlook

Key Highlights

Ethereum prices hit a fresh one-month high and closed above $3,000 for the first time since Feb 17th. It hit an intraday high of $3,149.80 and is currently trading around $3,145.

On the daily chart, the pair is trading above Tenken-sen ($2,867), Kijun-sen ($2,787), and Ichimoku Kumo cloud ($2,789).

Major support is seen at $3,000, any violation below this level confirms intraday bearishness. A dip till $2,940/$2,880/$2,800/$2,740/ $2,670/$2,600 is likely.

The immediate resistance is around $3,199 (Feb 15th high), any break above targets of $3,300/$3,512 is possible.

RSI – Bullish

A possible option could be long on dips around $3,100 with SL around $2,940 for TP of $3,500.

TradingView

XRP/USD Outlook

Intraday trend – Bullish

Key support – $0.70, $0.50

Key Resistance – $0.865 (Mar 12th 2022)

XRP’s price has been consolidating in a narrow range between $0.8650 and $0.81750 for the past four days. Any jump above $0.8650 confirms a bullish continuation, it is currently trading around $0.84111, short-term trend reversal only if it breaches $1.02 (the 23rd Dec high).

A possible strategy could be buy above $0.860 with SL around $0.80 for a TP of $1.02.

ADA/USD Outlook

Intraday trend – Bullish

Key support – $0.95, $0.80

Key Resistance – $1.30

ADA/USD showed a minor profit booking after hitting a recent 6 week high. Any breach above $1.20 confirms further bullishness, it is currently trading around $1.145. Short-term trend reversal only if it breaks $1.57.

A possible option could be long around $1.078-80 with SL around $0.95 for a TP of $1.570.

Bitcoin Support /Resistance

Resistance

R1- $46,000, R2- $50,000, R3- $52,000

Support

S1- $43,500,S2- $42,500,S3- $41,000

Ethereum Support/Resistance

Resistance

R1- $3,200, R2- $3,300, R3- $3,500

Support

S1- $3,000, S2- $2,820, S3- $2,740

See more at the Newsweek Cryptocurrency Index:

The content of this article is for informational purposes only and does not constitute financial or investment advice. It’s important to perform your own research and consider seeking advice from an independent financial professional before making any investment decisions.

Getty Images

More Stories

The Layers of CMMC Compliance with a CMMC Consultant’s Aid

Fairy House: A Journey into the Magical World of Miniature Dwellings

How to promote your trips to Baku on social media