Up-to-date, Oct. 3, 2022 – With the books closing on 3rd-quarter new-car or truck income, the market indeed—as forecast—is trapped in a very low equipment. At a model level, product sales results are markedly inconsistent. Hyundai and Kia are confirming file results General Motors and Toyota concluded the quarter with sturdy figures. Others, such as Buick, Nissan and Honda, go on to struggle. At an marketplace degree, just the reverse is real. New-car or truck product sales volumes have been on a remarkably dependable streak, averaging about 1.1 million units a thirty day period for extra than a 12 months now. Yr to day, new-auto profits are down more than 10{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} vs . 2021 and are on study course to finish at the lowest stage in a ten years.

Past week, during the Cox Automotive Q3 Forecast simply call, our workforce reduced its comprehensive-calendar year gross sales forecast to 13.7 million models and confirmed anticipations that new-motor vehicle profits in Q4 would continue on to reside in the 1.1 million neighborhood, held in look at by substantial rates, limited stock and softening desire. Greater curiosity charges are starting to right impression the new-motor vehicle market place, knocking some prospective buyers to the sidelines. As Main Economist Jonathan Smoke mentioned on the call, subprime purchasers accounted for about 14{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} of the new-vehicle marketplace in 2019. Now, subprime potential buyers account for just 5{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}, and deep subprime prospective buyers have all but disappeared. Bigger loan charges are impacting brand name-degree gross sales inconsistently. The bigger premiums will also probable tilt the U.S. marketplace even more into luxury territory, as substantial-profits vehicle consumers are typically in a position to spend income or secure much better mortgage costs.

There are indications that some automakers in Q3 started leaning far more heavily into fleet revenue to offset slowing retail need, but that is the exception, not the norm. For the most component, new-car stock is superior than it was 1 year back, but it continues to be relatively limited. A huge the vast majority of sellers are equipped to offer autos before they get there at the dealership, trying to keep accessible stock amounts quite low. We count on business-vast incentive stages to remain traditionally lower as very well, despite the fact that the Market Insights workforce will be thoroughly looking at sure automakers with high degrees of stock.

Total, in overall, September and Q3 new-automobile sales appear to have landed about exactly where we experienced forecast—roughly equal to yr-back amounts. Brace for a lot more of the exact same in Q4.

ATLANTA, Sept. 28, 2022 – September U.S. vehicle revenue, when verified upcoming week, are anticipated to show a new-motor vehicle sector primarily unchanged from past months and nevertheless trapped in minimal equipment. In accordance to the Cox Automotive forecast produced nowadays, September U.S. new-motor vehicle income are expected to finish in close proximity to 1.10 million models, with a gross sales rate, or seasonally modified once-a-year fee (SAAR), of 13.3 million. Revenue volume in September is anticipated to display an increase of practically 8{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} over final yr but end down pretty much 4{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} in contrast to very last month. The decline in comparison to last thirty day period is largely attributed to 1 much less promoting day.

In accordance to Charlie Chesbrough, senior economist at Cox Automotive: “New-auto sales have been remarkably dependable by means of the 3rd quarter, with profits of somewhere around 1.1 million units every single thirty day period in July, August, and September. New-car stock has been keeping steady, with days’ offer close to 40.”

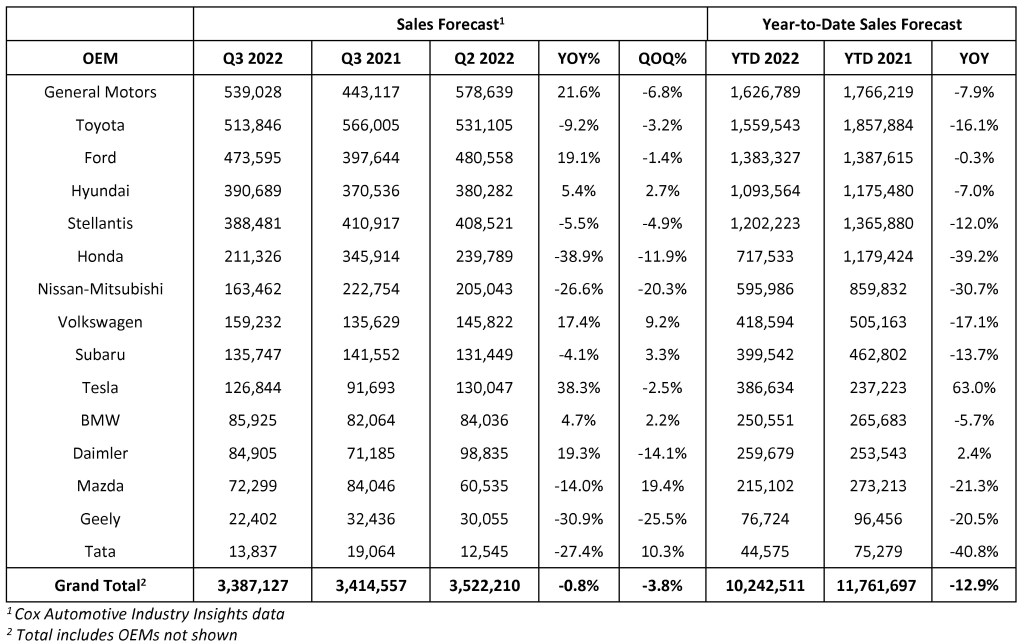

With the September final result, complete new-automobile gross sales in the third quarter are forecast at 3.4 million units, down fewer than 1{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} from Q3 2021 and down only modestly from the 3.5 million units marketed in Q2 2022. For comparison, income in Q3 2019 achieved 4.3 million. Normal Motors, Ford and Tesla will be amongst the major gainers yr about 12 months in Q3, with numerous Japanese brands, still battling with inventory challenges, scheduling the most sizeable declines, notably Honda and Nissan.

One particular calendar year in the past, the new-auto marketplace began suffering a considerable deficiency of inventory, and the gross sales rate fell to 12.3 million in September 2021. Stock has improved given that but stays effectively under pre-pandemic levels. Additional Chesbrough, “The offer shortage has likely designed some pent-up demand—folks who have been in essence waiting in line for stock to return. But the modern improvements in the financial outlook from soaring curiosity rates is beginning to chip away at demand, and the waiting line for new autos is probable getting substantially shorter.”

With no noteworthy inventory enhancement forecast in the fourth quarter and waning new-automobile need, Cox Automotive has decreased its whole-yr forecast to 13.7 million units, down from 14.4 million. Gross sales in 2022 are projected to finish down a lot more than 9{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} compared to 2021 and at the lowest stage in a ten years.

September 2022 Income Forecast Highlights

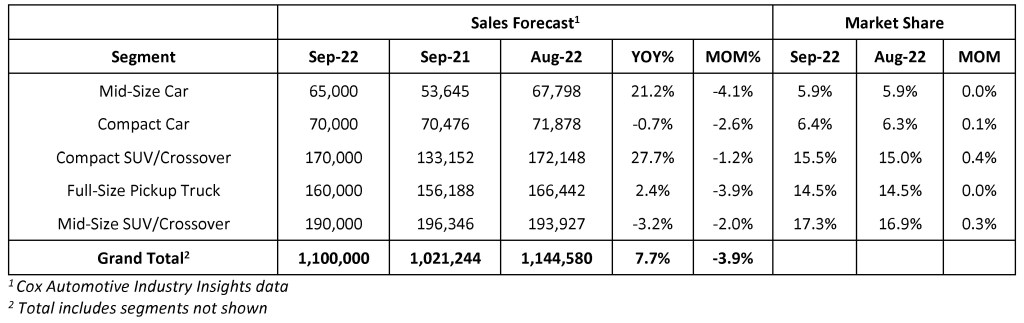

- New-automobile gross sales volume is forecast to rise 7.7{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} from September 2021 but decline 3.9{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} from final month.

- The SAAR in September 2022 is believed to be 13.3 million, higher than final year’s 12.3 million level and up .1 million from previous month’s tempo.

- September 2022 had 25 offering days, just one a lot less than August but equal to September 2021.

September 2022 Product sales Forecast Highlights

- Complete product sales keep regular through Q3, consistently at 1.13 million models a month. Calendar year-to-date income at the finish of Q3 are predicted to be down virtually 13{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}.

- Common Motors retains the top location as the best-advertising automaker in the U.S. market in Q3, thanks partly to stock improvements versus 2021.

- Tesla is forecast to achieve share again in Q3 and maintain the top rated location as the ideal-advertising luxurious automaker in the U.S.

All percentages are dependent on uncooked quantity, not each day advertising price.

About Cox Automotive

Cox Automotive Inc. can make obtaining, offering, owning and employing vehicles less complicated for every person. The world company’s a lot more than 27,000 staff associates and relatives of makes, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping hundreds of thousands of auto buyers, 40,000 automobile seller consumers across five continents and lots of other people all over the automotive industry thrive for generations to occur. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based enterprise with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

[email protected]

Dara Hailes

470 658 0656

[email protected]

More Stories

Slip and Fall Lawyers: Your Guide to Legal Support After an Accident

Best Sounding Engines

New Lamborghini: The Apex of Automotive Innovation