LONDON — The Financial institution of England will suspend the planned commence of its gilt promoting next week and start out temporarily obtaining lengthy-dated bonds in buy to calm the sector chaos unleashed by the new government’s so-known as mini-spending plan.

Yields on U.K. authorities bonds, recognised as “gilts,” were being on class for their sharpest every month increase because at the very least 1957 as buyers fled British fastened cash flow marketplaces adhering to the new fiscal policy bulletins. The measures included significant swathes of unfunded tax cuts that have drawn world criticism, which includes from the IMF.

connected investing news

In a statement Wednesday, the central financial institution mentioned it was checking the “sizeable repricing” of U.K. and worldwide property in new times, which has hit lengthy-dated U.K. authorities debt specially difficult.

“Had been dysfunction in this sector to continue on or worsen, there would be a materials risk to British isles monetary stability. This would lead to an unwarranted tightening of financing disorders and a reduction of the flow of credit score to the serious economic system,” the Lender of England said.

“In line with its economic steadiness objective, the Lender of England stands ready to restore market functioning and lessen any challenges from contagion to credit history problems for United kingdom households and organizations.”

As of Wednesday, the lender will start out non permanent purchases of extended-dated U.K. federal government bonds in get to “restore orderly market place conditions,” and reported these will be carried out “on no matter what scale important” to soothe marketplaces.

The bank’s Economic Plan Committee on Wednesday acknowledged the dysfunction in the gilt industry posed a substance chance to the country’s economic steadiness, and opted to consider speedy action.

The Monetary Policy Committee’s goal of an once-a-year £80 billion ($85 billion) reduction of its gilt holdings continues to be unchanged, the lender reported, with the initial gilt profits — to begin with slated for Monday — now using location on Oct. 31.

A U.K. Treasury spokesperson confirmed that the operation had been “entirely indemnified” by the Treasury and reported that Finance Minister Kwasi Kwarteng is “fully commited to the Financial institution of England’s independence.”

“The Govt will continue to function carefully with the Bank in support of its monetary balance and inflation aims,” the spokesperson additional.

The lender mentioned it will publish a marketplace discover outlining the operational aspects of the plan “soon.”

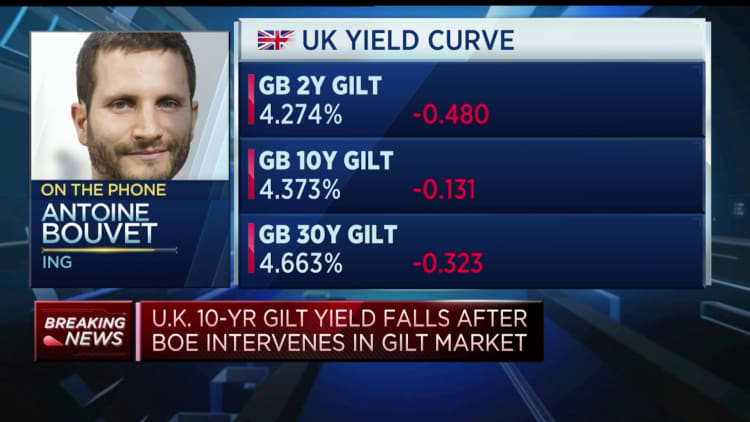

Yields on U.K. 30-yr gilts and 10-12 months gilts dropped sharply following the announcement, while sterling originally fell 1.5{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} from the greenback in advance of recovering marginally to trade at all-around $1.066 by mid-afternoon in London.

‘Caught in a crossfire’

Antoine Bouvet, senior rates strategist at ING, explained that the Bank of England may need to have to increase the bond purchases beyond the initial two-7 days time period if volatility in the gilt current market continues, and that an supplemental hike in fascination costs was not off the desk.

Bouvet explained to CNBC right away following the announcement that the bank’s first priority for now experienced to be the working of the gilt market, suggesting the worst consequence would be for the sovereign to be left without the need of market access and not able to protected financing.

“Obviously the gilt industry was caught in a crossfire between the Lender of England and the Treasury, and it is not specifically like that but it seemed a whole lot like they were being competing, or working at crossed needs,” Bouvet reported.

“So you have a entire world where you have a economic downturn and the BOE is hoping to awesome the overall economy with hikes, and on the other hand you have the Treasury that is seeking to protect the financial state from that economic downturn and employing fiscal measures that are inflationary.”

He additional that the Treasury’s assertion of assist was vital, noting that the federal government would be eager to keep away from the impact that the gilt industry is in “so significantly hassle” that it experienced compelled the Bank of England to acquire hold of rescuing the economy.

More Stories

Business Tips for Beginners: Navigating Success in Your Ventures

Navigating Technical Support: Tips for Streamlining Operations

Five Tips to Selecting the Right Security Camera Monitoring Services