Our purpose listed here at Credible Functions, Inc., NMLS Selection 1681276, referred to as “Credible” under, is to give you the resources and assurance you require to enhance your finances. Whilst we do encourage merchandise from our spouse loan providers who compensate us for our expert services, all viewpoints are our have.

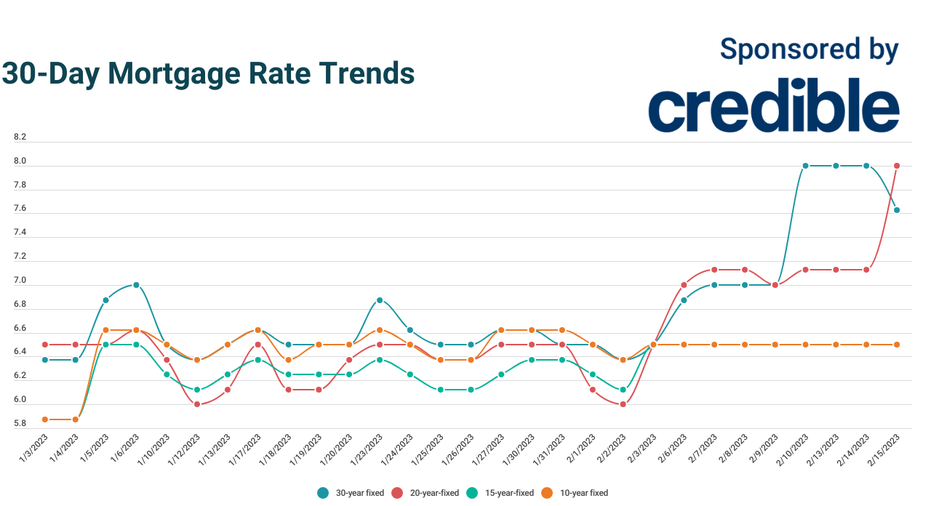

Check out out the home loan charges for Feb. 15, 2023, which are mixed from yesterday. (Credible)

Based mostly on information compiled by Credible, home loan charges for residence purchases are combined today, with a person important fee falling, a person increasing and two others keeping steady due to the fact yesterday.

Costs previous up to date on Feb. 15, 2023. These premiums are dependent on the assumptions proven below. True charges may perhaps vary. Credible, a own finance market, has 5,000+ Trustpilot evaluations with an average star score of 4.7 (out of a doable 5.).

What this indicates: Rates for a 30-12 months mortgage fell extra than a quarter of a share issue now, bringing this well-known reimbursement term again below 8{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}. In the meantime, 20-yr charges rose almost a full share position and 10- and 15-12 months premiums held constant. Consumers who want a longer compensation expression may well want to lock in a 30-year amount today. A charge lock could maintain their mortgage loan price continuous at under 8{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}, irrespective of long run increases. But prospective buyers looking to help you save the most on desire might want to contemplate 10- or 15-calendar year rates, which are the lowest obtainable at 6.5{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}.

To uncover wonderful home finance loan premiums, start by working with Credible’s secured site, which can demonstrate you present-day mortgage loan prices from several lenders without the need of influencing your credit rating rating. You can also use Credible’s house loan calculator to estimate your month to month property finance loan payments.

Based on info compiled by Credible, home loan refinance costs have fallen for two important phrases and remained unchanged for two other conditions considering that yesterday.

Charges final up-to-date on Feb. 15, 2023. These prices are primarily based on the assumptions shown below. True rates may perhaps differ. With 5,000 reviews, Credible maintains an “great” Trustpilot rating.

What this implies: Home owners hunting to refinance to a more time compensation expression have a further opportunity to help you save on curiosity today with 30-12 months prices, which are down just about a full percentage issue considering the fact that yesterday. But owners who want to help save the most on fascination may want to take into account 15-year fees, which held continuous these days at 5.375{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}. Fifteen-yr refinance phrases present a minimal curiosity charge and the option to be property finance loan-no cost quicker.

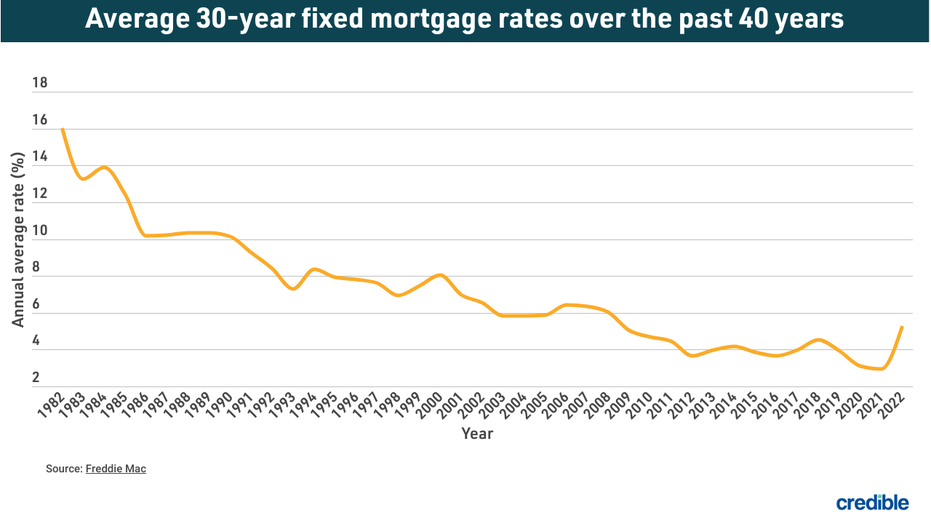

How home loan premiums have transformed around time

Today’s property finance loan curiosity prices are nicely beneath the maximum yearly common fee recorded by Freddie Mac — 16.63{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809} in 1981. A yr just before the COVID-19 pandemic upended economies throughout the entire world, the common desire rate for a 30-yr set-price home loan for 2019 was 3.94{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}. The regular level for 2021 was 2.96{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}, the cheapest yearly typical in 30 years.

The historic fall in fascination prices usually means property owners who have mortgages from 2019 and older could likely recognize sizeable interest financial savings by refinancing with one of today’s reduced interest fees. When thinking about a home loan refinance or obtain, it is significant to take into account closing fees these types of as appraisal, software, origination and attorney’s fees. These elements, in addition to the interest rate and mortgage amount, all contribute to the cost of a home finance loan.

How Credible house loan rates are calculated

Changing financial disorders, central financial institution policy choices, investor sentiment and other components affect the movement of mortgage rates. Credible common property finance loan charges and home loan refinance fees reported in this article are calculated centered on information delivered by partner creditors who pay payment to Credible.

The fees believe a borrower has a 740 credit score score and is borrowing a common loan for a solitary-loved ones house that will be their most important residence. The fees also think no (or very reduced) discount factors and a down payment of 20{cfdf3f5372635aeb15fd3e2aecc7cb5d7150695e02bd72e0a44f1581164ad809}.

Credible mortgage loan charges documented below will only give you an notion of existing common costs. The charge you basically obtain can vary dependent on a number of variables.

Mounted vs. adjustable-rate mortgages: How they impact curiosity costs

Curiosity prices for fixed-price home loans do not adjust more than the daily life of the loan, but have a tendency to be greater than the preliminary curiosity price for adjustable level mortgages, or ARMs.

Preliminary desire costs for ARMs are commonly decreased than fastened-level mortgages. But following the close of an introductory period, your desire fee will change — and it could maximize noticeably. Introductory periods can change from a number of months to a calendar year or a few a long time. Soon after the introductory period, your desire level will be centered on an index your loan provider specifies. ARMs may well or may well not cap how significantly your desire price can maximize.

If you are hoping to locate the appropriate mortgage loan amount, take into account utilizing Credible. You can use Credible’s totally free on the net instrument to effortlessly compare numerous lenders and see prequalified charges in just a number of minutes.

Have a finance-connected issue, but don’t know who to request? E mail The Credible Dollars Pro at [email protected] and your problem might be answered by Credible in our Revenue Pro column.

More Stories

Business Tips for Beginners: Navigating Success in Your Ventures

Navigating Technical Support: Tips for Streamlining Operations

Five Tips to Selecting the Right Security Camera Monitoring Services