Sky substantial inflation. Increasing desire charges. Falling dwelling buys.

Analysts are working to digest a host of indicators about the point out of the U.S. overall economy, which emerged from a pandemic economic downturn much better than any one could have considered.

This week, individuals alarming developments collided with one more big details issue showing U.S. gross domestic item shrank in the very first quarter of 2022.

However, several economists believe that a official economic downturn — the economic system going into reverse for two consecutive quarters — is not imminent.

“This is sounds not signal,” wrote Ian Shepherdson, chief economist at Pantheon Macroeconomics study group, of the GDP facts in a note to clients. “The financial state is not slipping into recession.”

That sentiment was echoed by Invoice Adams, main economist at Comerica Bank, who observed in a tweet that client paying, expenditure and career development keep on being wholesome.

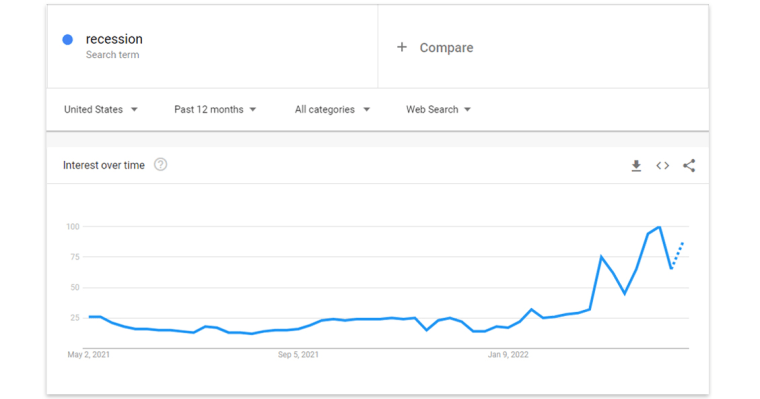

Still, a lot of People are feeling jittery. Amongst the indications: searches for “recession” have been spiking on Google this month.

“There are without doubt a large amount of problems for the U.S. economic climate,” claimed James Knightley, chief intercontinental economist at the monetary services team ING. “You have received a problem wherever households are feeling the squeeze of higher fuel and foods charges, and wages that are not necessarily retaining rate.”

Current customer sentiment readings also advise quite a few Americans usually are not positive where their economic futures are headed. Complicating issues: The extremely-very low curiosity price surroundings that has dominated the U.S. economy for many years has occur to an finish, with the Federal Reserve poised to hike its essential benchmark rate following week for the next time in practically two months.

As a consequence, whilst most economists are selected that advancement will start out slowing in the coming months, there is debate about how serious the drop will be, and what it all implies for normal People in america.

“Men and women are emotion careful — and we’ve just started off to get greater fascination charges,” Knightley claimed. “It’s unnerving for people.”

Warning indicators

On Wednesday, the U.S. Bureau of Economic Analysis reported the U.S. gross domestic product or service, among the the broadest actions of expansion observed by economists, shrank 1.4 per cent. GDP represents the sector price of items and expert services made in a region all through a certain time period of time.

Still several economists were unfazed by the negative path of the facts, expressing it was typically a quirk of technological things in how GDP is calculated.

In particular, the knowledge ended up heavily affected by a surge in imported items — a signal that desire truly stays fairly strong.

“Mainly because there was these kinds of a enormous backlog of ships waiting around to unload in American ports, imports stayed superior in the very first quarter,” Comerica’s Bill Adams mentioned, which means The us was in a trade deficit. “So it showed up as a reduction in GDP, which meant purchasers had been heading to obtain more foreign products and significantly less American products and solutions.”

But there are other indicators suggesting all may possibly not be perfectly in the economic system. At the stop of March, a essential element of the bond marketplace linked with recessions reared its head. It’s regarded as an inverted generate curve. It can be what transpires when it will become riskier to hold short-time period bonds than it is to keep more time-phrase types.

According to the Federal Reserve Bank of San Francisco, inverted yield curves have preceded each individual recession since 1955, although sometimes it really is taken two decades for an economic contraction to arrive soon after an inversion has happened.

Only once, in the 1960s, has the curve inverted and a economic downturn not followed soon just after.

On March 29, the produce curve inverted — meaning bond-prospective buyers made a decision shorter-phrase threats to financial progress were raising relative to for a longer period-phrase kinds.

ING’s Knightley mentioned this won’t rule out a economic downturn totally. “But it is a flashing warning sign that we want to choose very seriously.”

Authorities like Knightley stress that if the warning indicator is right, common Us residents could get started to working experience larger unemployment and slower wage advancement, even as inflation starts to gradual down.

A steepening yield curve has been a function of our economic atmosphere in the latest months.

Exactly where will inflation go from in this article?

It is not crystal clear when an inflation slowdown will happen, or how quickly. Some economists think inflation peaked in March, when the consumer price index strike a 40-12 months high.

Nonetheless several economists believe inflation is very likely to linger for some time. In a be aware to shoppers unveiled this week, Bank of The united states said, “Recession threats are very low now but elevated in 2023 as inflation could power the Fed to hike until eventually it hurts.”

The financial institution is referring to the prepare by the Federal Reserve to increase interest prices to convey inflation less than control. The Fed has said it would elevate the benchmark desire fee six far more occasions in this calendar year, this means the price tag of borrowing revenue — to purchase homes, cars, just take out scholar financial loans and have credit rating card credit card debt — will develop into much more high-priced.

“Just about every recession is distinctive, but Fed hikes and commodity shocks have played a part in most recessions around the past couple a long time,” the bank wrote. “At present we are experiencing a modest variation of the two: a commodity shock from the Russia-Ukraine war and a considerable Fed tightening. Furthermore, the commodity rate spike is section of a considerably broader surge in inflation.”

At the moment, the financial institution mentioned, the main “imbalances” in the financial state are elevated spending on items, and what it named “a perhaps overheating labor sector.”

At the moment, it claimed, inflation is weighing closely on serious consumer paying out, which has climbed just 2.4 percent calendar year-on-yr in excess of the past three quarters. Despite this, the GDP info exhibit paying is nevertheless robust, with some exceptions. House loan programs a short while ago fell to their most affordable amounts in the write-up-Covid era, owing in massive section to higher curiosity fees.

But inflation could persist if over-all shopper demand remains also solid, thanks to the red-sizzling labor marketplace and the Covid-related lockdowns in China that are influencing provide chains all over again, Lender of The usa mentioned.

“[Economic] risks are elevated, and should surely be viewed as above common,” the lender mentioned. “If inflation comes in much better than predicted or growth falls swiftly, a recession would come to be the base scenario. But we are not there yet.”

How need to households put together for a prospective economic downturn?

Goldman Sachs chief economist Jan Hatzius pointed out in an April 17 observe to buyers that domestic balance sheets are healthier.

“The family web worthy of/disposable profits ratio [is] at the moment at a document high,” Hatzius explained, citing inventory sector highs via significantly of 2021 and the record quantity of money folks saved up through the pandemic. “The private sector overall [is] working a healthier monetary surplus,” Hatzius reported.

“This signifies that a slowdown in revenue progress thanks to a monetary coverage-induced cut in labor need is significantly less likely to pressure homes to slash back again sharply on investing,” Hatzius extra — indicating families will possible continue to keep enjoying the capability to devote revenue on what they want and want due to the fact their fiscal balance sheets are so nutritious proper now.

“This probable raises odds of averting a recession,” he stated.

So what can people do to get ready for a economic downturn? Ironically, it is the panic of a downturn that can generally cause just one.

“Setting up for a economic downturn is the best cocktail to conclude up with a recession,” explained Gregory Daco, chief economist at EY-Parthenon, Ernst & Young LLP. “So it oftentimes becomes a self-fulfilling prophecy: Customers get started to acquire considerably less, or retrench, and then firms start facing additional economical challenges, they start off to retain the services of fewer, then incomes fall. It qualified prospects back into vicious loop.”

In the end, he reported, it will fall on the Fed to nail the financial dismount. Right now, he said, a economic downturn is not imminent. But dependent on what the Fed does — and how markets reply — a recession could be a likelihood in the next couple of a long time.

Even though a recession is a danger, it is not a guarantee, Daco reported. “There is no assurance we conclusion up in a recession, for the reason that the Fed will be capable to rethink, recalibrate monetary coverage. But it is a chance as we appear into 2023.”

So, a bit of age-aged assistance continues to be correct for folks and families hunting to fortify their funds just before a recession: have an crisis personal savings account, use no more than about 30 p.c of your offered credit rating, pay out down substantial-interest debt and be aware of paying on nonessential items and services.

More Stories

Business Tips for Beginners: Navigating Success in Your Ventures

Navigating Technical Support: Tips for Streamlining Operations

Five Tips to Selecting the Right Security Camera Monitoring Services