Vareto, a startup aiming to help organizations perform additional ahead-looking monetary planning and investigation, is coming out of stealth nowadays with $24 million in full funding.

GV (formerly Google Ventures) led its $20 million Collection A this yr, and Menlo Ventures led its $4.2 million seed financing in the summertime of 2020. Menlo also put funds in the company’s most up-to-date spherical, in addition to 40 angel traders, including tech unicorn founders and chief monetary officers. The angels who possibly backed the enterprise in its seed or Sequence A spherical are a large-profile bunch, and contain Asana COO Anne Raimondi, Salesforce President and ex-CFO Mark Hawkins, Splunk CFO Jason Little one, Fb CFO Dave Wehner, Affirm CFO Michael Linford, Egnyte CEO and co-founder Vineet Jain, Microsoft CVP Manik Gupta and Hippo Insurance’s VP of Finance Roy Hefer. Communicate about validation.

In its own words, Mountain Look at-dependent Vareto is developing a new system for FP&A (money scheduling & evaluation) teams with the intention of “building the upcoming of money setting up.”

1 of the factors that stands out about Vareto — other than its remarkable checklist of early buyers of course — is its founding workforce. Prior to stints as an investor, CEO Kat Orekhova was head of products at Ironclad and held a wide variety of roles at Facebook, such as head of forecasting and analytics. When at the social media large, Orekhova states she crafted Facebook’s “first-ever” info science team in just FP&A. President Lalit Singh is the previous COO of Udacity and effectively led that corporation to being hard cash stream optimistic following getting on the verge of shutting down. Prior to joining Udacity, he invested several yrs at Hewlett-Packard Enterprises wherever he did factors such as guide that company’s digital transformation of HPE’s $3 billion program small business and serve as COO of its $2 billion Cloud organization and VP of operational efficiency.

The pair teamed up in 2020 to appear up with a system that would give FP&A teams the skill to “seamlessly” work throughout organizing and reporting cycles. In other words, it desires to help this sort of groups be far more proactive and appear toward the long run as an alternative of reactive and “looking in the rearview mirror.” Their purpose was to build a strategic finance platform for the organization that had the seem and come to feel of a shopper presenting.

For Orekhova, Vareto’s purpose is possibly even additional uncomplicated — to help providers operate much better with an integrated planning and reporting device that aims to streamline the complete FP&A course of action.

“Questions these as ‘How are we accomplishing as a small business and how could we be carrying out even much better? are tricky to solution currently,” she stated.

And the groups tasked with answering these questions (FP&A) are the ones attempting to set business enterprise targets. So people teams are the primary concentration of Vareto.

“For example, we spoke to a hardware firm whose crew takes four months to place collectively the business summary for the prior month,” Orekhova described. “So this signifies they are always a month driving in the visibility into their small business functionality.”

It is notably tricky, she extra. To comprehend how a small business is doing, primarily a quite big business business with quite a few obtained businesses throughout distinctive organization traces and different geographies, “you have to pull data from many distinctive methods, you have to talk to several stakeholders” to have an understanding of what’s going on.

“And so assembling this see of your business enterprise is truly seriously tough now, and scheduling is even worse,” Orekhova added.

The approach of arranging on normal takes five months for a significant corporation.

“So as you can think about, by the time this course of action finishes, the plan is incredibly considerably out of date,” she explained to TechCrunch. “And that is definitely why we begun Vareto — simply because we saw this remarkable lag concerning knowing how your company is undertaking, and basically becoming equipped to make an operational improve to make items better.”

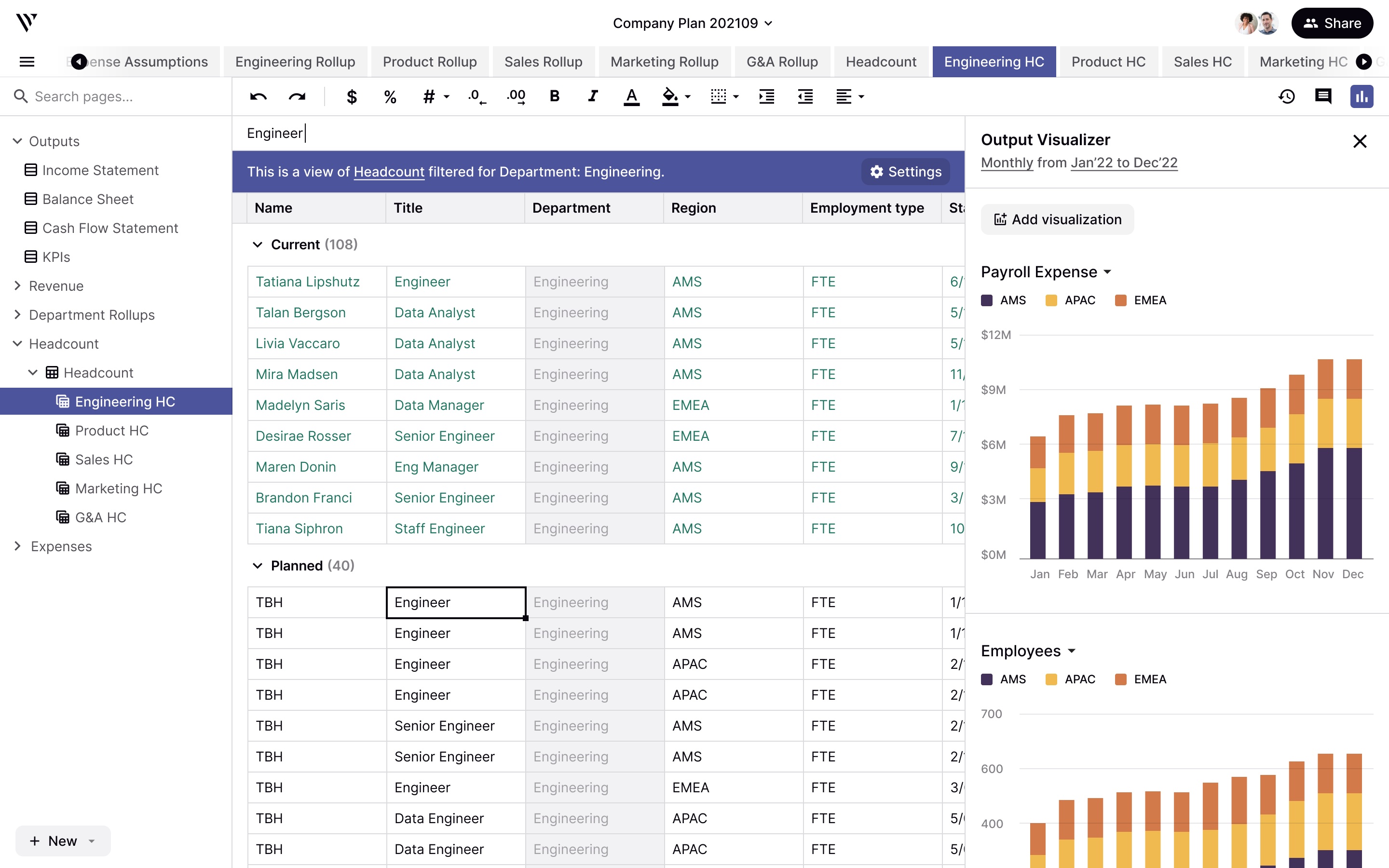

Image Credits: Vareto

The B2B SaaS startup hence aims to turn into a command heart for the finance and government groups to see how a business is accomplishing in serious time and to be in a position to make essential operational changes speedier.

“If you see a gap in an possibility, you can promptly place assets towards that in times, not months,” she reported.

For the duration of his time operating HP’s cloud business enterprise, Singh recalls having “three distinct solutions from a few distinctive teams” about buyer churn, for illustration.

“I would be confused, which responses should really I feel?” he mentioned.

So Singh finished up assembling a 10-person “shadow finance and ops team” to get “the appropriate facts at the proper time.”

Later on when he joined Udacity, he struggled with acquiring a forecast for a supplied year.

“You have a number of units and many enterprises and obtaining data from them, and putting the appropriate layer of details, just requires tons of time,” he explained. “At both of those firms, I didn’t have the luxurious of having a answer like we are creating.”

Sadly, the startup declined to expose any tricky profits figures, expressing only that its customers span distinct industries this sort of as gross sales enablement, protection and residence tech and incorporate Mindtickle and Landing, between other folks.

Vareto’s traders are normally bullish on what the startup is performing.

Naomi Pilosof Ionita, companion at Menlo Ventures, led Vareto’s seed round very last calendar year.

She observed an authenticity in the founding workforce that appealed to her. In addition, she stated, she liked how Vareto “marries monetary metrics with running metrics”

“Often, these are composite metrics and the fundamental levers are worthy of comprehending,” Pilosof Ionita informed TechCrunch. “Forecasting just can’t be an ivory tower approach. It is a collaborative work out with executives throughout the enterprise who have the a variety of inputs.”

The VC suggests she skilled that firsthand when working merchandise growth and monetization at Bill2go.

“Regarding set up incumbents in this space, we listen to from their people that a large amount of analyses and forecasts continue to default to Excel documents getting emailed back again and forth,” she extra. “FP&A groups have to have a extra modern system that is collaboration to start with and handles details interoperability nicely.”

Tyson Clark, basic companion at GV, explained he was not only impressed with the founding group and their merged practical experience, but also the simplicity of use of the system.

“It’s clean and easy to understand and use,” he informed TechCrunch. In simple fact, he was so taken with the platform, he backed the corporation at the Sequence A phase — a departure from his common investing at B and C stages.

Helping firms make business enterprise far better choices carries on to catch the attention of investor pounds at an progressively rapid speed. Previously this week, we reported on Sisu Data raising $62 million for its real-time Final decision Intelligence Engine, which aims to give analysts and organization leaders a way to review their cloud details to not only have an understanding of what’s going on in their company, but why it’s happening and what actions to get in reaction.

More Stories

Business Tips for Beginners: Navigating Success in Your Ventures

Navigating Technical Support: Tips for Streamlining Operations

Five Tips to Selecting the Right Security Camera Monitoring Services